|

Opening a Savings Account (SA) at Rightangle Mutual Benifits India Nidhi Ltd

comes with many added privileges compared to other Financial Institution, co-operative societies and banks. Rightangle Mutual Benifits India Nidhi Ltd provides a No Frills Account to members, i.e. the members can operate the account at zero balance too.

Additionally, you also get annual 7.00%* of savings account interest rate which is compounded on a quarterly basis.

| Rightangle Nidhi Savings Account Features & Benefits | 1. Minimum Balance Required – NIL (No Frills Account) 2. Interest Rate – 7.00%* per annum (Quarterly Interest pay out) 3. Unlimited Transactions without any charges 4. No TDS Deduction on interest for Members (as per current IT act) 5. Nomination Facility 6. SMS Facility |

|

Being one of the most energetic Nidhi Company/ Mutual Benefit societies in India, Rightangle Mutual Benifits India Nidhi Ltd provides the best financial products to their members. Right from basic products to exclusive products, we at Rightangle Mutual Benifits India Nidhi Ltd make sure that our members get secure investments and great interest on their investments.When it comes to opening a Savings Account with Rightangle India over any other bank or other financial Insitution, Rightangle India wins the race. This is because of the extra privileges that we are offering compared to any other financial institution. ‘No Frills Account’ is one such privilege that allows you to open a zero balance savings account with Rightangle India. Also, our savings account interest rate is 7.00%* which payable on quarterly basis. Now this ultimately helps you make good savings. So open a savings account with Rightangle India and get high saving interest rates.

|

|

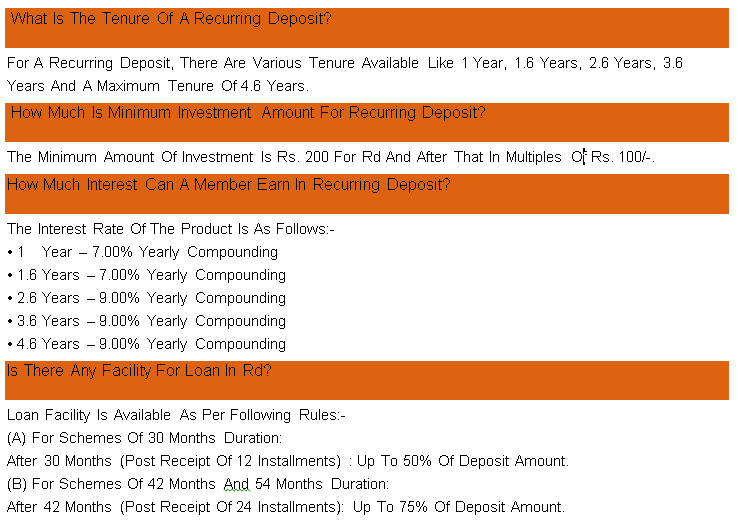

Recurring Deposit (RD) account lets member’s deposit a fixed installment every month on which they earn a cumulative return (Yearly Compounding) on maturity. Rightangle provides Recurring Deposit (RD) interest rates depending on the tenure of the Recurring Deposit (RD).

For investment of Rs.200 per month:

|

|

| |||||||||||||||||||||

|

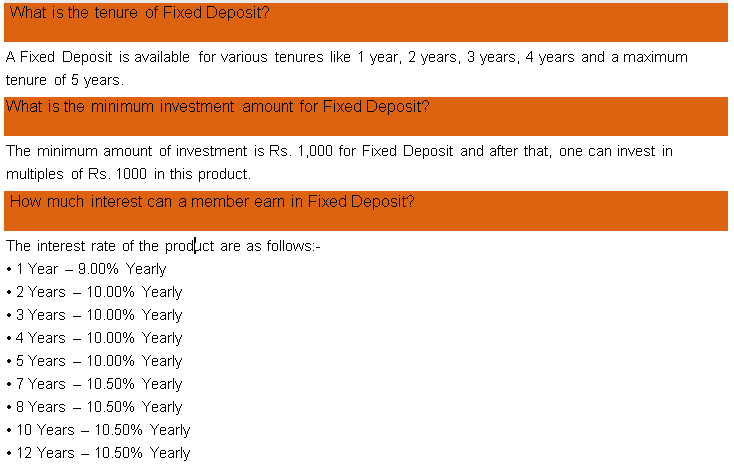

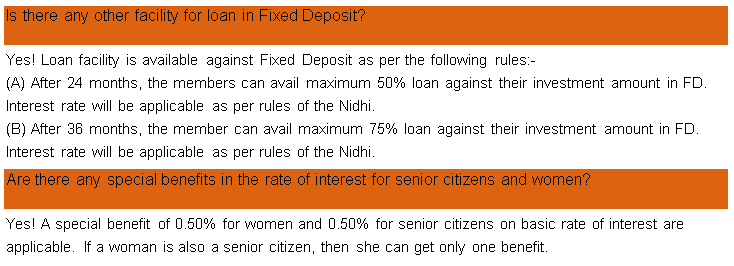

Fixed Deposit is available with various tenures which the members can choose as per their requirement. Attractive FD interest rates are offered based on the tenure of your Fixed Deposit. Have a look at the FD interest rates for different tenures.

|

|

Additional Special Interest Rates*

| 0.50% additional interest for women members on Fixed Deposit 0.50% additional interest for senior citizens (members above 50 years age) on Fixed Deposits

| ||||||||||||||||||||||||

|

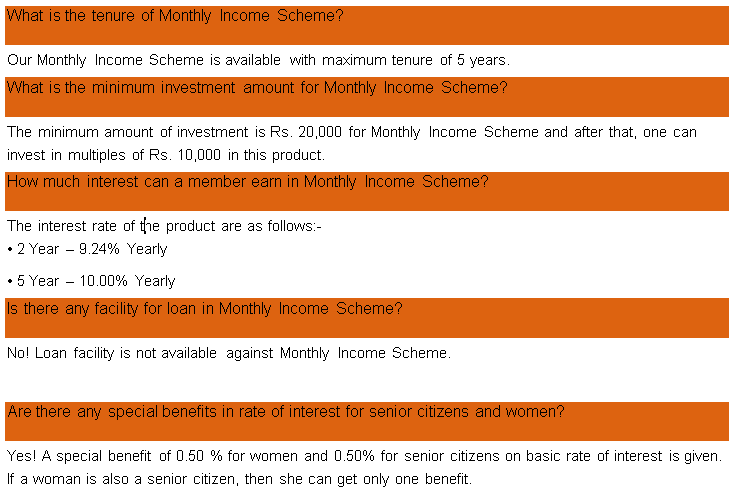

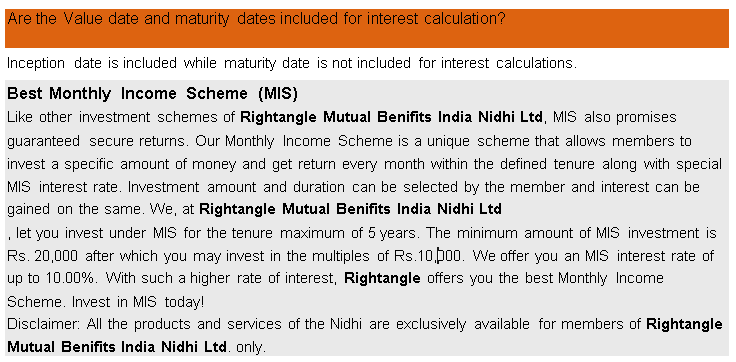

The Monthly Income Scheme (MIS) is a unique scheme where members can invest a specific amount and get returns every month till the end of the tenure at our competitive MIS interest rate. Members can choose investment amount along with the duration and earn interest on the same.

|

|

Special Interest Rates*

| 0.50% additional interest for women on fixed deposits 0.50% additional interest for senior citizens (members above 50 years in age) on FD *Special interest rates applicable as per Nidhi’s Terms & Conditions Interest rates effective from October 09, 2018

| |||||||||||||

|

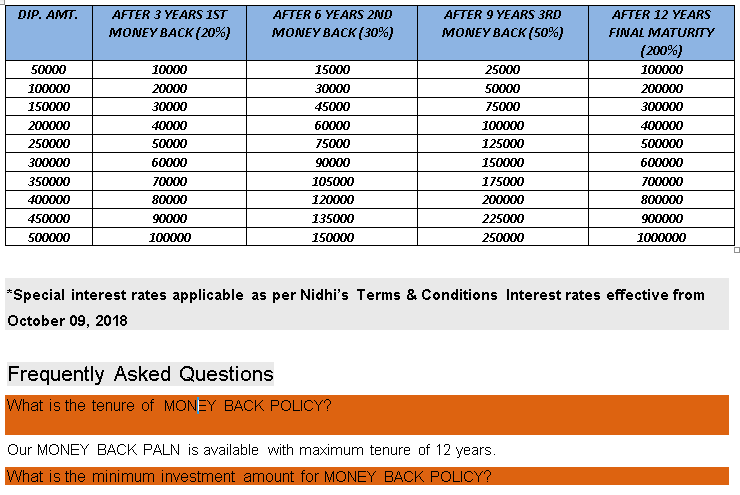

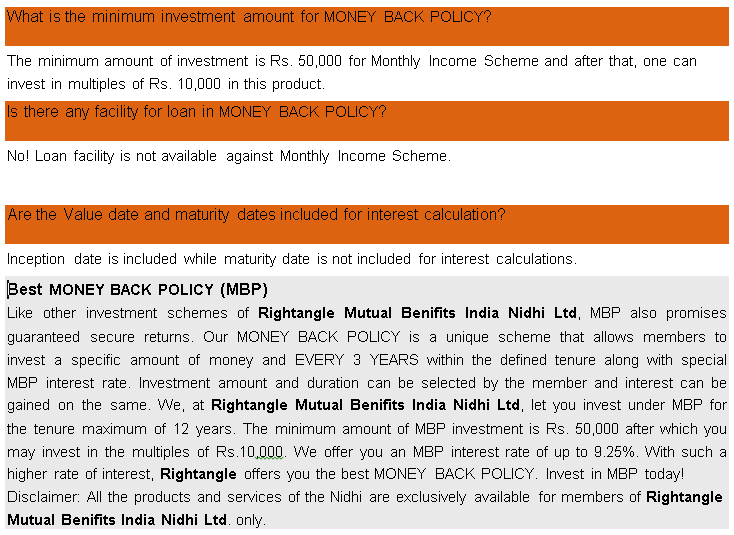

The MONEY BACK POLICY (MBP) is a unique scheme where members can invest a specific amount and get returns every month till the end of the tenure at our competitive MBP interest rate. Members can choose investment amount along with the duration and earn interest on the same.

|

© 2020 All Rights Reserved Rightangle